tax benefits of retiring in nevada

Ad Begin Saving For Your Retirement Today - Your Future Self Will Thank You. Nevada has a 685 percent state sales tax rate a.

10 Pros And Cons Of Living In Nevada Right Now Dividends Diversify

Your retirement income - If you are retiring and making more than 35k per annum during your retirement then Reno might be good.

. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Nevada has far more sunny days and lower humidity to enjoy them than most states. Pros of Retiring in Nevada Plenty of Sunshine Flourishing Economy Low Taxes Home to Las Vegas Tons of Natural Beauty Flexible Laws Open 247 Abundant Property.

Yes NPS is a government backed retirement scheme which also provides taxation benefits under Section 80C of Income Tax Act. Tax benefits of retiring in nevada Thursday August 4 2022 Nevada offers an abundance of tax advantages for relocating home and business owners alike including. Get this guide and learn 7 investing strategies to help you generate retirement income.

Nevada does not have an individual income tax. Tax benefits of retiring in nevada Saturday June 11 2022 Edit. The employees after-tax contribution is refundable upon termination of employment if you do not elect to receive a.

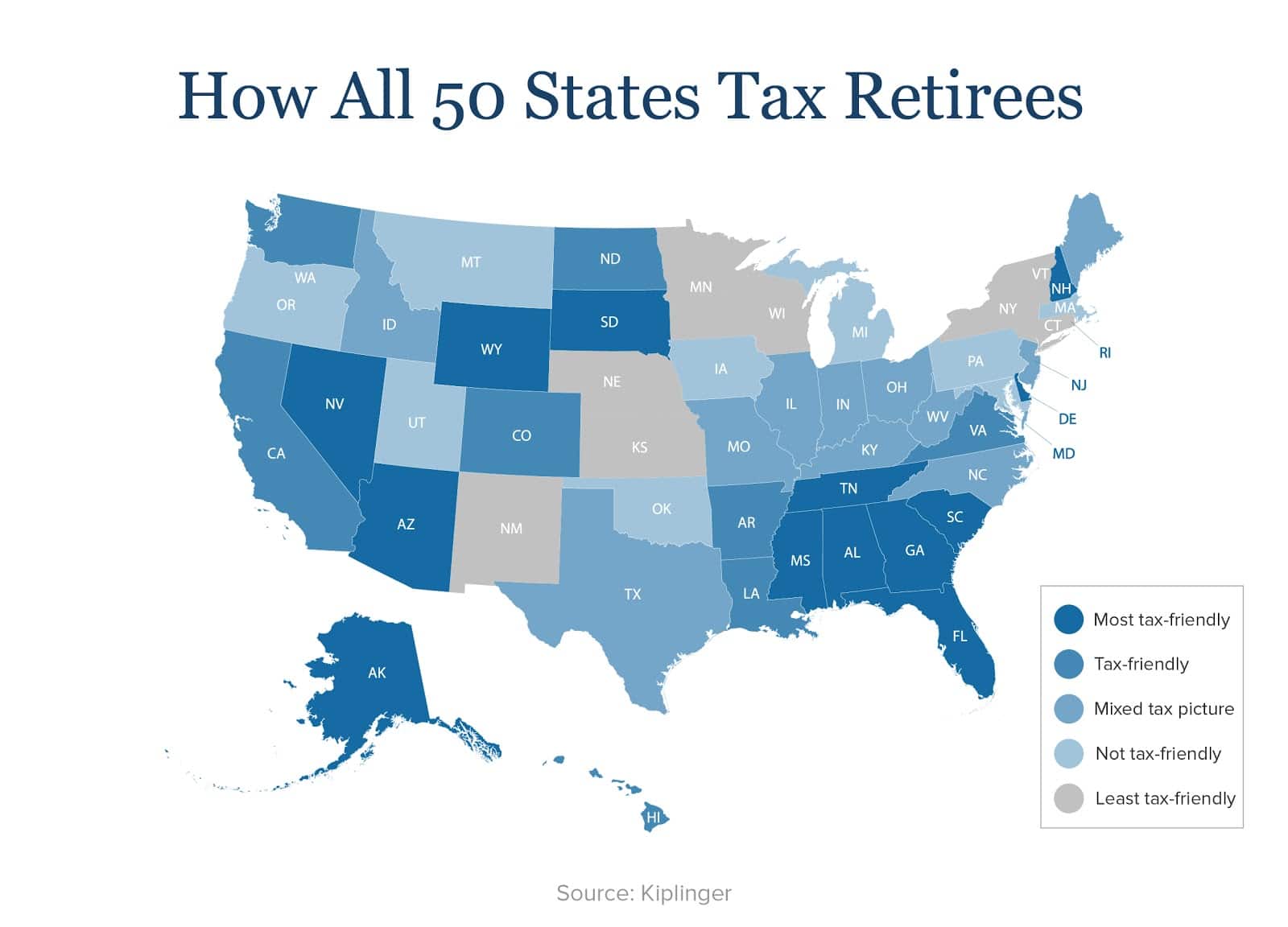

Nevada famously does not have a state income tax nor does it have an inheritance or estate tax. The contribution rate for Policefire members is 2075 of gross salary. We dont make judgments or prescribe specific policies.

In the top 10 of states according to data from NOAA. See what makes us different. However prescription medications and consumable grocery items are.

Simply just multiply the property tax rate by the your assessed value 032782 district tax. It is independent of any investment made in. That means that many relocating residents will receive a tax benefit of up to 24 depending on.

Youll Likely Pay Less in Taxes. Nevada is one of 6 states in the United States with no state income tax. The current state sales tax is 685 percent with an additional 125 percent assessed by counties.

Ad Fisher Investments shares these 7 retirement income strategies to help you in retirement. Most importantly Nevada is especially tax-friendly toward retirees. Take 3 Minutes To Learn How To Boost Your Retirement Savings.

However recently housing and other prices. Nevada does not have a corporate income tax but does levy a gross receipts tax.

37 States That Don T Tax Social Security Benefits The Motley Fool

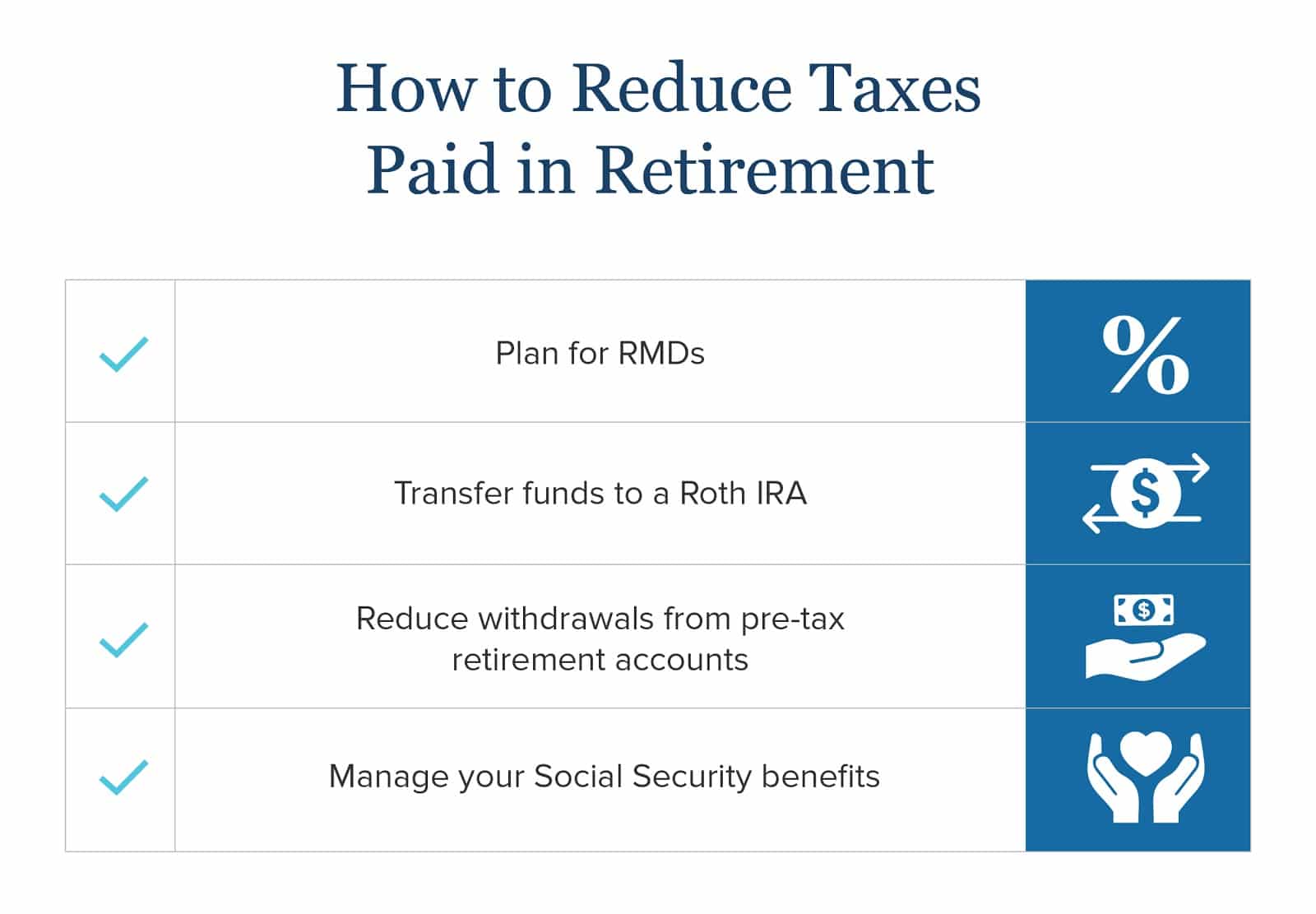

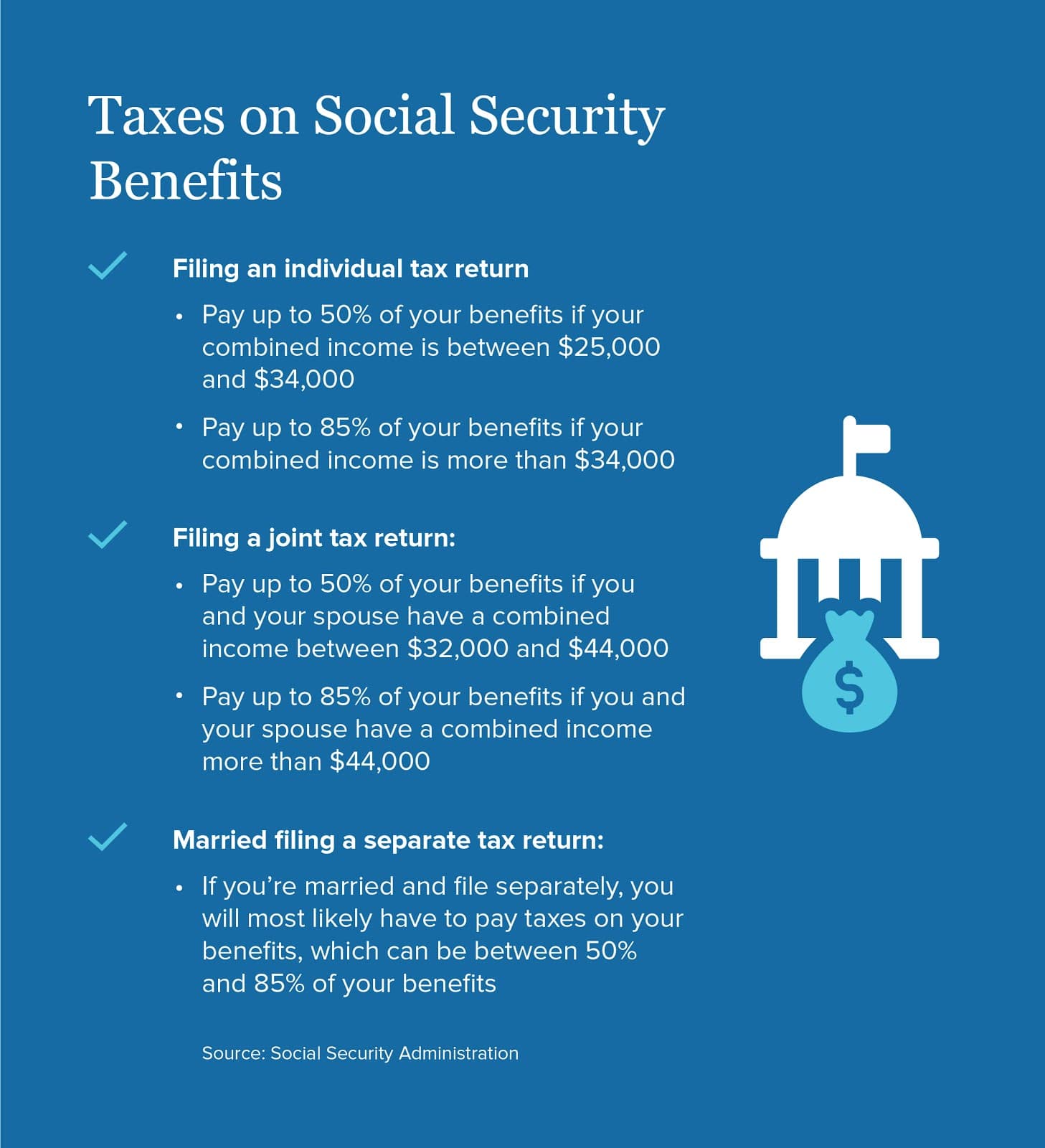

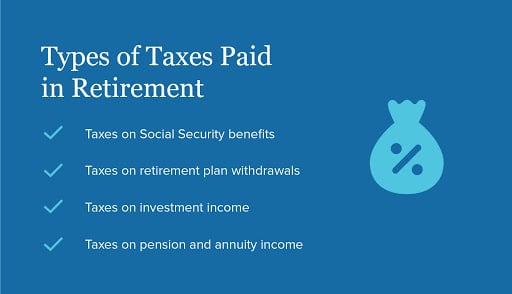

How To Plan For Taxes In Retirement Goodlife Home Loans

Nevada Tax Advantages And Benefits Retirebetternow Com

Monday Map State Income Taxes On Social Security Benefits Social Security Benefits Map Social Security

The Best Places To Retire Outside The Us Best Places To Retire Belize Travel Guide Belize Travel

Annuity Beneficiaries Inheriting An Annuity After Death

Is My Pension Subject To Michigan Income Tax Center For Financial Planning Inc

Moving Out Of State Don T Forget About The Source Tax Mullin Barens Sanford Financial

Will Your Planned Retirement Income Be Enough After Taxes Brady Martz Associates

37 States That Don T Tax Social Security Benefits The Motley Fool

Choosing A Retirement Destination Tax Considerations Lvbw

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

How To Plan For Taxes In Retirement Goodlife Home Loans

38 States That Don T Tax Social Security Benefits The Motley Fool

How To Plan For Taxes In Retirement Goodlife Home Loans

Best Hot New Restaurants In Las Vegas Nv Las Vegas Las Vegas Hotels Momofuku

How To Plan For Taxes In Retirement Goodlife Home Loans

14 States Don T Tax Retirement Pension Payouts Retirement Pension Pensions Retirement