tax strategies for high income earners australia

Specifically contribute to a traditional 401 or IRA. The first way you can reduce your taxable income and therefore your tax on that income is through additional superannuation contributions.

How To Pay Less Taxes For High Income Earners Wealth Safe

This is also called salary packaging and it works a few different ways.

. Structuring your business and personal assets. Tax deductions are the permitted expenses meant for reducing taxable income as well as tax liability. Actual high salary earners have limited options really.

Asset and debt structuring can be key to. According to an analysis of countries around the world by Price Waterhouse Cooper Australia is ranked nearly at the top of tax rates for high-income earners. Here are 50 tax strategies that can be employed to reduce taxes for high income earners.

Some of them legal some not-so. Holding tax deductable income protection. The extra 15 tax imposed under the Division 293 rules is applied because as a high-income earner your marginal tax rate without the 2 Medicare levy for income amounts over 180000 is 45 in 202122.

Investing in Early Stage Investment Companies ESIC Investing in Early Stage Venture Capital Limited partnerships. Maximizing your voluntary superannuation contributions is an allowable tax deduction that is a further significant long-term wealth creation strategy. Jun 19 2019.

Given that most are employed in specialist occupations this takes greater time and a more detailed investigation to ensure that cover is appropriate for your circumstances. With the Medicare levy already legislated to increase from 15 to 2 from 1 July 2014 the rise in levies will effectively be 25 for. This rate is lower than the personal income tax rate.

As a general overview the most beneficial strategies for tax minimisation are. The contribution you will make. Take Home Rates for an annual income of 400000.

Hold investments in a discretionary family trust for tax-effective income distribution. Post Covid Income Inequality Deloitte Insights How Do High Income Earners Reduce Taxes In Australia 5 Strategies To Reduce Investment Taxes 2. When you make a concessional contribution into your super account however you only pay a 15 tax rate.

Additionally tax-deferred accounts benefit by compounding returns faster by sheltering income from current taxation. These penalties can range from fines to imprisonment for more. Most legal ways of avoiding tax involve you spending money and claiming a tax deduction for spending that money.

A discretionary trust would be used for distributing business profits investments. If you are an employee and you have an employer-sponsored 401k or 403b in 2018 you can contribute up to 18500 per year of your gross income. A family trust or a discretionary trust can be a means for them to build wealth if they apply tax-effective financial strategies.

However tax-deferred accounts can be an effective tax strategy for high-income earners to reduce current year tax liabilities. Negatively gearing a property or an investment into shares. Effective tax planning with a qualified accountanttax specialist can help you to do that.

For those trying to learn how to save tax in Australia salary sacrificing is one way to do it. Australias high-income earners can invest in family trusts. Tax Saving Strategies for High-Income Earners.

So a banker doctor making 1m. A range of both basic and advanced tax strategies and investment options can be explored to this end. The amount of offsets you get from your taxes Having a smaller capital gains tax CGT liability.

Our highest marginal income tax rate kicks in at around 2x average earnings vs about 4x in most other countries and the rate of 47 is not low. Tax avoidance and evasion on the other hand is illegal and attracts heavy penalties from the Australian Tax Office ATO. If youre wondering why you should do so here are some of the ways it can help you to lower your tax bill.

August 12 2014. A discretionary family trust can be beneficial for high income earners who are seeking to redistribute some of their income to family members on lower tax brackets. Republic Of Armenia In Imf Staff Country Reports Volume 2019 Issue 031 2019 August 12 2014.

In this case they could distribute the trusts profits to trustees while remaining under the tax-free threshold thereby creating wealth by decreasing their tax. The other way high income earners reduce tax in Australia is by having a savvy and switched on accountant who specialises in this area. Make spousal contributions to reduce your tax liability.

Australians earning over 27k pay the Medicare Levy calculated at 2 of an individuals taxable income. There are a couple of other options as well including carefully structuring any income-earning assets and making sure you have private health insurance so you dont have to pay the Medicare Levy Surcharge. With salary sacrificing a taxpayer would put some of their pre-tax income toward a benefit before they are taxed.

In australia the tax laws make it so that the highest earners of the country are taxed at unbelievably high rates. Change the Character of Your Income One way to reduce your tax burden is to change the character of your income. Maximize All Your Allowable Tax Deductions.

The Medicare Levy Surcharge is charged at an additional 1-15 of an individuals taxable income. Australia overtaxes high wage income earners relatively speaking. Delay receiving income to avoid paying tax in the current financial year.

How Can A High Earner Reduce Taxable Income In Australia. If you are a high-income earner it is sensible to implement tax minimisation strategies. However Im going to show you two ways to avoid tax without spending a cent.

Tax deductions you may want to maximize. High income earners singles earning 90k and couples with a joint income of 180k without Private Health InsuranceHospital Cover must also pay the Medicare Levy Surcharge. In Australia the tax laws make it so that the highest earners of the country are taxed at unbelievably high rates.

Here are the 5 tax deductions for high earners plus a 6th tax hack at the end of the post. Contribute to your Superannuation Fund. The taking care of your partners assets.

With the budget announcement of a temporary 2 budget repair levy for taxable incomes above 180000 those who will be affected may wish to consider some planning strategies to lessen the impact. There are a number of ways to avoid tax in Australia. Appropriate types and amounts of insurance cover.

As a refresher for 2021 FY the individual tax rates including medicare levy are. Prepay tax-deductible expenses to bring your tax deduction forward. 50 Best Ways to Reduce Taxes for High Income Earners.

Consider salary sacrificing to reduce your taxable income. Now we must be careful with the term avoid tax because tax. Reduce the income tax paid on dividends through franking credits.

Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. So what are the top tax planning strategies for high income employees.

![]()

How Do High Income Earners Reduce Taxes In Australia

Tax Reform Welcome But More To Do Betashares

How Do High Income Earners Reduce Taxes In Australia

Tax Reform Welcome But More To Do Betashares

Advanced Tax Strategies For High Income Earners In Australia Solve Accounting

Personal Income Tax Cuts Now Law Morgans

How Do High Income Earners Reduce Tax In Australia Imagine Accounting

How Do High Income Earners Reduce Taxes In Australia

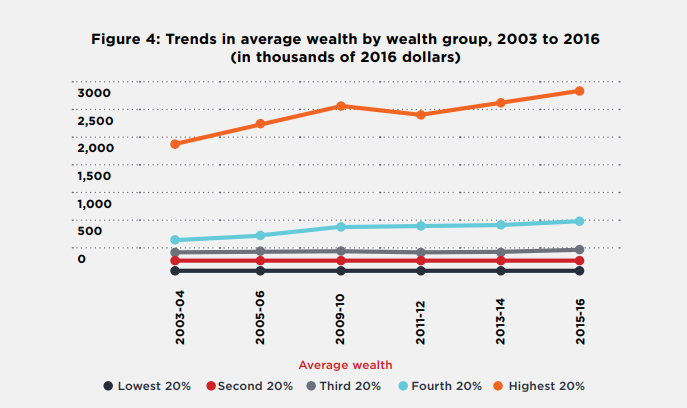

Inequality In Australia 2018 Html Acoss

What Is Considered A High Income Earner In Australia Ictsd Org

Some Of Australia S Highest Earners Pay No Tax And It Costs Them A Fortune Greg Jericho The Guardian

How To Reduce Taxes For High Income Earners Australia Ictsd Org

How To Pay Less Taxes For High Income Earners Wealth Safe

Retirement Incomes How Does Australia Stack Up Save Our Super

What Is Considered A High Income Earner In Australia Ictsd Org

Tax Minimisation Strategies For High Income Earners

How Do High Income Earners Reduce Taxes In Australia

How Do High Income Earners Reduce Taxes In Australia

News Factcheck Is 50 Of All Income Tax In Australia Paid By 10 Of The Working Population Institute For Governance And Policy Analysis